A recent report by Vestian, an occupier-focused workplace solutions firm, reveals that approximately 60% of India’s Grade-A office space qualifies as REIT-worthy. This presents a significant opportunity for Real Estate Investment Trusts (REITs) to reshape the commercial real estate landscape in India.

REITs: A Growing Investment Opportunity in India

REITs are a type of investment that allows individuals to invest in large-scale commercial real estate properties, such as office buildings, shopping malls, and hotels, without owning the physical properties themselves. They operate by pooling funds from multiple investors to purchase and manage real estate, generating income primarily through rent, which is then distributed to investors in the form of dividends.

India’s REIT Market: Current Scenario and Future Prospects

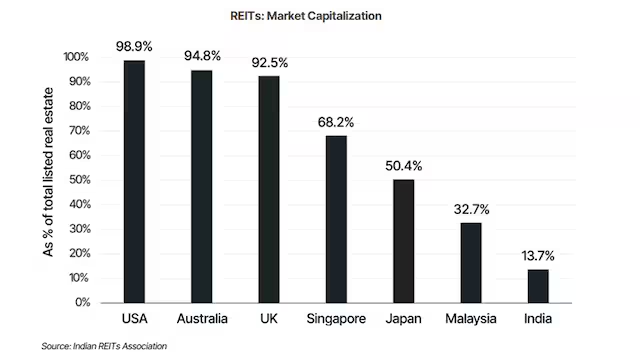

Currently, there are only four listed REITs in India, covering 125 million square feet of office and retail space. Compared to global markets, India’s REIT market is small, with countries like the USA, Australia, and the UK having much larger REIT markets.

“Gradually, REITs are becoming popular among foreign and domestic investors owing to attractive returns in the form of dividends. Since their inception, REITs have distributed Rs 16,800 crore, more in dividends compared to the entire NIFTY Realty Index,” noted Vestian.

REIT Performance vs. Other Real Estate Investments

The major REITs in India, such as Embassy REIT, Mindspace REIT, Brookfield India REIT, and Nexus Select Trust REIT, have provided varying returns ranging from 6% to 39% since their inception. In contrast, the BSE Realty Index has given 317% returns in the last 66 months.

City-wise Analysis of REITs in India

The distribution of REIT-worthy properties in India is concentrated in major cities, with Bengaluru leading with 33% of the REIT-worthy stock, followed by Hyderabad with 21%, NCR with 15%, Mumbai and Pune with 21%, Chennai with 10%, and Kolkata with 1%.

Sustainable REIT-worthy Stock

Nearly 67% of the total REIT-worthy stock in India is green-certified, highlighting the increasing focus on sustainability among Grade-A developers. Green-certified buildings command a rental premium of 12-14% over non-green buildings.

Future of REITs in India

“In a nutshell, currently REITs are at an early stage of growth in India but are gradually expanding, driven by favourable regulatory environment and proactive government policies from the SEBI,” noted the report.

Amal Mishra, Founder and CEO, UrbanVault, said, “The demand and absorption for Grade A offices are projected to grow steadily. Recognizing this trend, many developers are actively focusing on this segment, with new projects in the pipeline to address the increasing need for premium commercial spaces.”

Image courtesy: business-standard.com